I write from Jackson Hole Wyoming as the early morning sun shines sharply on the Grand Tetons where I just spent a very enjoyable few days at the annual monetary conference. I have been coming to these Jackson Hole conferences on and off since the first one on monetary policy in 1982, and as usual I learned a lot. Here is a brief sampling. I recommend reading the papers and the commentary once they are posted by the Kansas City Fed.

The main thing I took away from Ben Bernanke’s opener (the tradition going back to Paul Volcker and Alan Greenspan is for the Fed chair to lead off) was his call for a “cost-benefit” approach to determine whether another dose of unorthodox large scale asset purchases is needed. This is a big improvement over a “whatever it takes” approach, and it opens the door to a transparent discussion of the costs and benefits of such policies. My own view (based on research with Johannes Stroebel) is that the benefits in terms of lower rates are very small, while the short-term costs of greater uncertainty about the exit strategy and long-term costs from a loss of independence are large.

Larry Christiano presented a new and interesting modification of the Taylor rule which replaces the output gap with a measure of credit growth. He presented some preliminary model simulation work to see how his idea would work in practice. Given the measurement problems with the output gap, more research along these lines would be valuable. Milton Friedman once proposed that I consider replacing the output gap with money growth (M2) in the Taylor rule, which is a similar proposal.

Jim Stock and Mark Watson presented a novel model for inflation forecasting. It focuses entirely on the statistical regularity that inflation declines during recessions. Most important for the current economic situation was their finding that the chances of deflation are quite low right now.

Alan Blinder and I presented our separate critiques of Bank of England Deputy Governor Charlie Bean’s ideas for future monetary policy. Charlie started off by revisiting the critique I presented at the 2007 Jackson Hole conference that policy rates were too low for too long leading up to the crisis; he mentioned recent work by Ben Bernanke, but omitted other papers which I brought to people’s attention. I was surprised that Charlie placed so much emphasis on studies of Fed asset purchases which simply looked at announcement effects, recalling my experience running the international division at Treasury where announcement effects in the currency markets are usually offset soon afterwards. Alan Blinder argued for a more discretionary and interventionist approach, buying more assets including private sector assets. I stressed the benefits of getting back to the rules-based Framework that Works, which is how I labeled the policy that was used effectively for most of the 1980s and 1990s. Here is my commentary. Read Alan’s when it is posted. This debate will continue.

Throughout the conference the growing U.S. government debt problem was the gigantic elephant in the room. Eric Leeper’s dramatic exploding debt charts and his plea for a more scientific approach to fiscal policy analysis made this problem crystal clear for everyone, even though public finance economists in the audience vigorously defended their approach. This debate will also continue.

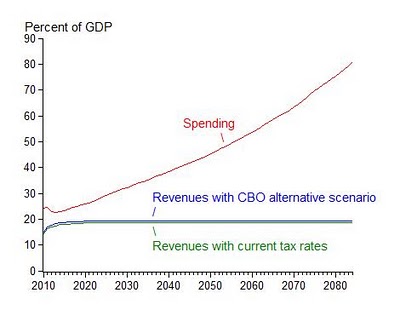

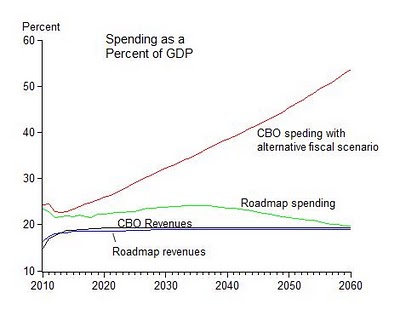

The second chart shows spending and taxes under the Roadmap and the CBO Alternative; the Ryan Roadmap focuses on controlling the growth of spending as a share of GDP, which makes sense because that is where the growth of the deficit is coming from.

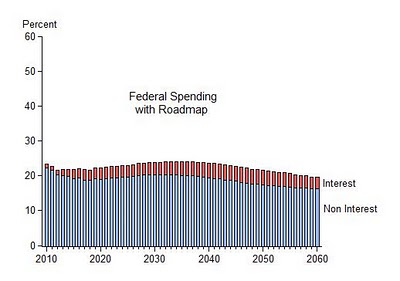

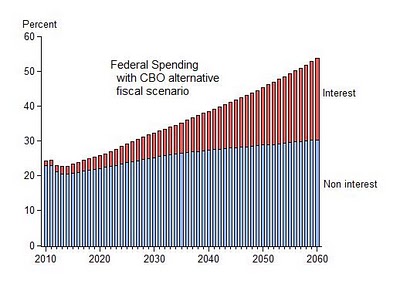

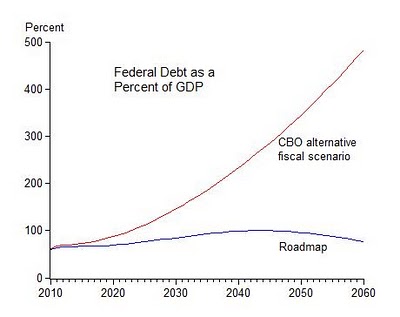

The second chart shows spending and taxes under the Roadmap and the CBO Alternative; the Ryan Roadmap focuses on controlling the growth of spending as a share of GDP, which makes sense because that is where the growth of the deficit is coming from.  The third and fourth charts show how the Ryan Roadmap takes action to control non-interest spending now and thereby dramatically reduces interest payments on the debt in the future.

The third and fourth charts show how the Ryan Roadmap takes action to control non-interest spending now and thereby dramatically reduces interest payments on the debt in the future.