I am writing from Tokyo where I have spent a few days at the Bank of Japan. This week marked the first exchange market intervention by the Bank of Japan since March 16, 2004, a day I remember well because it was the last day of a massive exchange market intervention by Japan amounting to $320 billion and now called the Great Intervention. As U.S. Treasury Under Secretary for International Affairs, I worked closely with the Japanese on the start and the exit from the Great Intervention.

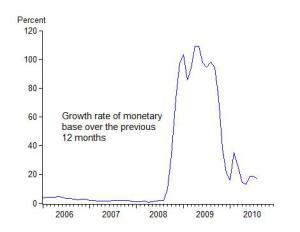

Some have asked me to compare this week’s intervention with the start of that earlier intervention because the earlier one was closely related to the Bank of Japan’s quantitative easing, a subject which is back on the table. Indeed, some are speculating that the recent intervention might be the start of another large dose of quantitative easing, not only in Japan but elsewhere. Today’s Financial Times front page story, Monetary Easing Fears Lift Gold To Record High reports that “Traders said Tokyo’s intervention in the yen market, which injected fresh liquidity into the Japanese economy, was a sign that central banks were prepared to begin a new round of quantitative easing. Traders said the Federal Reserve could follow suit next week at its monthly interest rate setting meeting, and that gold would probably benefit from it.”

The U.S policy toward the Great Intervention by Japan was part of a strategy to support Japanese efforts to increase money growth to levels achieved before the start of their deflation. So it did relate to quantitative easing. By not registering objections to the intervention, the U.S. made it easier for Japan to increase money growth. The strategy worked this way: When the Bank of Japan intervenes and buys dollars in the currency markets at the instruction of the Finance Ministry, it pays for the dollars with yen. Unless the Bank of Japan offsets—sterilizes—this increase in yen by selling (rather than buying) other assets, such as Japanese government bonds, the Japanese money supply increases. In the past, U.S. Administrations had leaned heavily against the Japanese intervening in the markets to drive down the yen. By adopting a more tolerant position toward the intervention—especially if it went unsterilized—we could help to increase the money supply in Japan. So when Zembei Mizoguchi, the vice Minister at the Japan’s Ministry of Finance, discussed the possibility in late 2002 that currency intervention was going to increase, I did not object, as the U.S. Treasury usually does.

After a few months into 2003, the unprecedented nature of the intervention became clear to everyone. The Japanese would not publicly announce their daily interventions, but the markets began to sense it, and at the end of each month the Japanese would report on the monthly totals. I had arranged for the Japanese to email me personally whenever they intervened in the market, and to call me about very large interventions. When I read email on my Blackberry in the early morning I would frequently find messages from Tokyo like “small intervention during Tokyo trading hours; 1.2 billion dollars purchased,” and I was awakened by quite a few late night or very early morning calls from Tokyo too.

By the summer of 2003, the data began to show that the Japanese economy was finally turning the corner. Though it was too early to be sure about the recovery in Japan, it seemed to me that the Japanese could soon begin to exit from their unusual exchange rate policy of massive intervention. For the next few months we worked with the Japanese on an exit strategy. By early February 2004, the Japanese decided to complete the exit and Zembei called me to outline their exit strategy: They would intervene even more heavily in the next month and then stop. The idea seemed strange to me, but the Japanese had never tried to mislead me, so I knew that this was indeed their strategy.

Intervention did increase and it was not until March 5, 2004 that we really saw the beginning of the end of the intervention. At 8:30 that morning, Washington time, the U.S. Labor Department released their monthly employment report. Employment for the month of February was up by only 21,000 jobs, much less than we or the market had anticipated. News like this would normally have a negative impact on the dollar because weaker jobs data would lower the chances of an interest rate increase by the Fed, thereby making the dollar slightly less attractive to investors seeking higher interest rates. But the dollar did not weaken and on March 5 the Japanese had purchased $11.2 billion dollars that day which made the dollar appreciate rather than depreciate as one would expect. They were not simply smoothing the market, they were working against it. Zembei had told me that they were going to do more intervention before they did less, but this was simply excessive. He was working against market fundamentals. I called him over the weekend to complain that this type of intervention was completely unwarranted and I was as forceful as a friend and ally could be. Zembei acknowledged that they were still intervening heavily now, but the March 5 dollar buy was part of the exit plan. I argued that the exit period had gone on long enough.

Zembei did soon stop intervening, after another week of heavy dollar purchases, but nothing that equaled March 5. The last purchase of dollars occurred on March 16 when the Japanese bought “only” $615 million. On the 17th my Blackberry reported no intervention, and again on the 18th. There was no intervention for the rest of March and the rest of the 2004, and all the way through 2005 and now through September 14, 2010. The yen did not strengthen much in the months after the Great Intervention ended.

My assessment, based on this experience, is that the recent intervention is not, and should not, be a repeat of the Great Intervention. While that intervention was not sterilized and quantitative easing occurred, many at the Bank of Japan did not think it was so successful. Moreover, the need for more liquidity in the Japanese banking system is not so obvious now. And the protectionist pressures in the United States are greater now, especially with the very weak U.S. economy. Complaints in the U.S. congress about the recent intervention are already greater than what we heard during the Great Intervention at the time.

In any case, I hope this perspective on the Great Intervention from a U.S. Treasury official at the time is useful. It is drawn in part from my book Global Financial Warriors.