For several years I have writing about an cycle in which economic policy swings toward and away from certain key principles of economic freedom. The poor performance of the U.S. economy during the past decade —the Great Recession, the Not-So-Great Recovery, the stagnation of real income growth—can be traced to a Great Deviation from these principles, or, as John Cochrane writes, to an Era of Great Forgetting of what policy works well. In the prior two decades—the period of the Great Moderation in the 1980s and 1990s—policy moved toward a greater adherence to these economic principles, and in the period before that, in the late 1960s and 1970s, policy swung away. During the past 5 decades policy appears to have swung back and forth with a frequency somewhat longer than typical business cycle, but shorter than the word secular conveys.

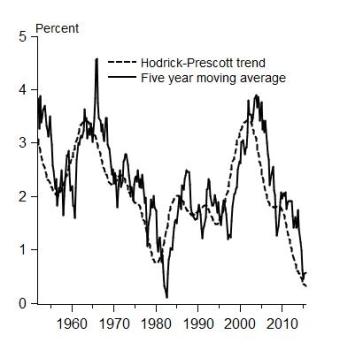

For remarks at a session at the recent AEA meetings on “The U.S. Economy: Where To From Here?” I looked at smoothed trends in labor productivity growth. I produced the graph below showing labor productivity growth for the nonfarm private business sector with high-frequency fluctuations smoothed out using a five-year moving average and a Hodrick-Prescott trend. Note how productivity has swung down and up and down again, roughly in tandem with the changes in policy, giving some evidence of an economic policy–performance cycle, which contrasts greatly with secular stagnation stories and gives hope for another upturn if there is a change in policies.

Regarding the recent low productivity growth, the Solow growth accounting formula points to both a decline in growth of total factor productivity and capital services per hour worked as explanations. According to the Bureau of Labor Statistics, annual labor productivity growth fell from 3.0% during the years 1996-2005 to 0.7% during the years 2011-2014, or by 2.3 percentage points. Over those same two periods, multifactor productivity growth fell from 1.6% to .6% per year, and growth in capital services per hour fell from 3.7% to an amazingly low -.5% per year. Thus a capital share of 1/3 implies a reduction in the contribution of capital from 1.2% to -.2%.

Restoring these two contributors to growth to their pre-crisis levels would give a 2.4% per year boost to productivity growth going forward far above the forecasts of economists who have written off a major change in policy such as pro-growth tax and regulatory reform.

Even assuming the “low hanging fruit have already been picked” story of technological progress and thus a continuation of low multifactor productivity growth, we could get a 1.4% increase in labor productivity growth to around 2% through more private investment which would raise the capital stock and services of both physical and intellectual capital. Tax and regulatory reforms—part of a move toward First Principles—would be expected to do just that

The recent swing down in labor productivity growth, along with the unusually low contribution from capital services, suggests that it could turn up again if boosted by reform-induced incentives. If so, policy reforms would not only raise the long-run growth rate of the economy, they would also likely bring an extra boost to growth in the short run.