Two years age in an

article in the Financial Times I wrote that “Standard and Poor’s decision to downgrade… should be a wake-up call for the US Congress and administration.” At that time I was not, of course, referring to the decision of last Friday, but rather to S&P’s downgrade of “its outlook for British sovereign debt from ‘stable’ to ‘negative’.” In that May 26, 2009 FT article I listed several reasons why I was concerned that Washington might “sleep through that wake-up call,” and many of those played out, at least until the elections of last November which brought in many new members to Congress who woke up and came to Washington. As a result we have the Budget Control Act of 2011, which is a good first step in a longer term plan to reduce spending.

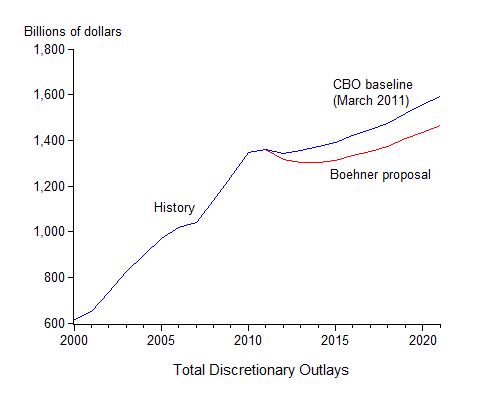

I have received several comments on my post yesterday on whether or not S&P’s initial assumptions about spending growth in its downgrade report represented a “difference of opinion” with other views or a “math error.” To my knowledge, the initial calculations which are in dispute have still not been made public, so perhaps we will never know for sure, but the main issue seems to be a “difference of opinion” about spending growth following the Budget Control Act (BCA). The argument that it was a “math error” is based on the idea that the BEA caps on discretionary spending are a fixed dollar amount and that S&P did not use those dollar amounts in their initial calculations.

I have been

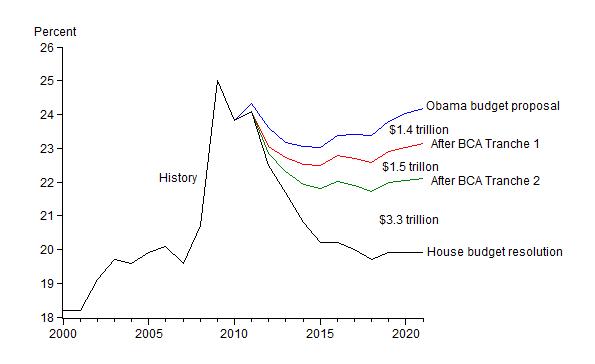

quite positive about the accomplishments of BCA, but its actual impact on spending may be less than the dollar amounts assumed by S&P in its final draft and closer to those apparently assumed in its first draft.

First, some of the deficit reduction could come in the form of tax increases (if the Joint Committee proposes some tax increases and they are approved) rather than spending reductions; in this case the change in tax revenues would have the same static dollar effect on the deficit, but then there are many potential offsetting effects, such as the current proposal to extend the payroll tax reduction or the slower economic growth if tax rates are raised.

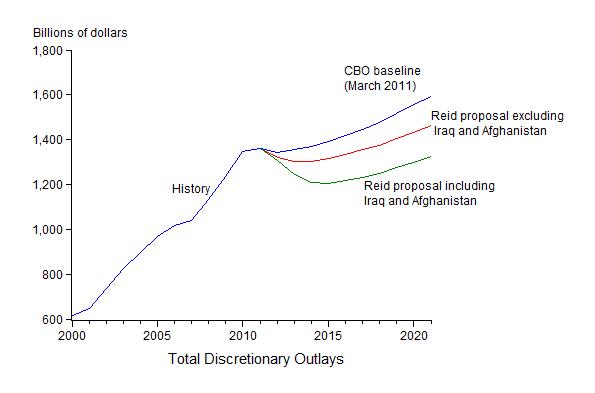

Second, BCA excludes Iraq, Afghanistan, and related discretionary spending; I hope and expect these to come down compared to CBO baseline, but there are differences of opinion.

Third, BCA caps can be changed or altered in the future, perhaps when appropriators find it difficult politically to pass legislation to achieve the caps. Several people have emailed me about this problem in questioning my view that BCA is an accomplishment.

Fourth, and this relates specifically to the chart in my post of yesterday, BCA does not apply through the whole period of the long term budget outlook, which uses CBO’s alternative fiscal scenario.

To clarify these issues, the Treasury and S&P could put out the details of their dispute, including the before and after assumptions and calculations. On the other hand, I do think people should move on.