At the end of this quarter, according to most economists, the U.S. economy will have completed 7 years of so-called expansion (28 quarters from 2009Q3 to 2016Q2) with an anemic annual growth rate of 2 percent. I have been writing about the persistence of this slow crawl—along with anemic productivity growth, anemic employment growth, anemic income growth—since the recovery’s early days, and blaming government economic policy all the way. See the list below of 30 posts on EconomicsOne.com which have also considered counter arguments from “weak recovery denial” to its just “secular stagnation” (click on “Slow Recovery” category in box over on the left for details).

But people’s exasperation and anger about the economy and Washington policy revealed in this presidential election proves the point better than any abstract statistic ever could. Many people are hurting in many ways. It is a tragedy and policy should change. For many, it’s economic exasperation rather than economic expansion.

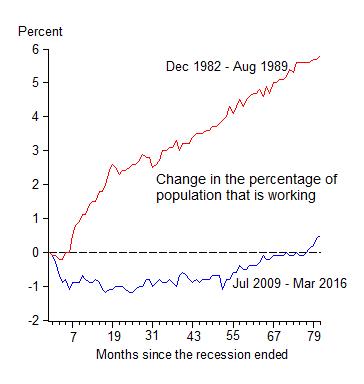

Here is an update of a graph I used early on to compare this recovery with the 1980s recovery.

And here is an update of a graph that makes the same comparison using the change in the employment to population ratio.

The recent performance pales in comparison as does economic policy. Compared with my charts in previous posts, it’s really “same old, same old” for GDP growth and while, if you look closely, you can see a welcome uptick in the employment to population ratio, even at that pace it will take many years to close the gap.

Here is a list of the EconomicsOne.com posts:

- Can We Restart This Recovery All Over Again? September 12, 2015,

- Growth Accounting for a Liberated Recovery, June 22, 2015,

- Liberate the Recovery March 4, 2015

- A Review of Recoveries in Contrast February 15, 2015

- The American Economy: Turtle or Caged Eagle? August 1, 2014

- Why Still No Real Jobs Takeoff? March 7, 2014

- First Principles Versus Secular Stagnation January 31, 2014

- With Better Policy, the Recovery Could Have Been V-Shaped September 16, 2013

- Detecting the Source of Our Recent Poor Economic Performance September 3, 2013

- What to Call This Very Slow Recovery? August 12, 2013*

- Crawling Along August 3, 2013

- Policy Uncertainty Makes Firms Reluctant to Hire: New Evidence July 31, 2013

- It’s Not Whether, It’s Why Recovery Has Been So Weak July 8, 2013

- Don’t Blame Weak Recovery on State and Local Spending Cuts June 15, 2013

- Job Growth–Barely Keeping Pace with Population June 10, 2013

- Ed Leamer on the Weak Recovery June 3, 2013

- Same Old Slow Recovery February 4, 2013

- A Slow and Declining Growth Rate Delays Prosperity November 1, 2012

- An Unusually Weak Recovery as Usually Defined October 26, 2012

- Weak Recovery Denial October 18, 2012

- More on the Unusually Weak Recovery October 15, 2012

- Simple Proof That Strong Growth Has Typically Followed Financial Crises October 11, 2012

- From Economic Scare Stories to the Other Side of Reality October 8, 2012

- Government Policies and the Delayed Economic Recovery August 29, 2012

- It’s Still a Recovery in Name Only–A Real Tragedy August 4, 2012

- More Evidence on What Is Holding the Economy Back May 13, 2012

- Debate and Evidence on the Weak Recovery May 2, 2012

- Reassessing the Recovery February 6, 2012

- The Two Year Anniversary of the Non-Recovery June 22, 2011

- Government Policy and the Slowdown July 20, 2010

*David Wessel @davidmwessel answered this question in a tweet on Aug 12, 2013: “John Taylor wonders what to call this very slow economic recovery? Suggest ‘The Great Delay’?” But after three more years, and seven years and counting, I think there’s “Waiting for Godot” absurdity to David’s suggestion.