In talks about my book First Principles I argue that shifts toward and away from the principles of economic freedom have had profound effects on economic performance. From the mid-1960s through the 1970s, deviations away from economic freedom were large, economic policy was bad, and economic performance was poor with rising unemployment and inflation and falling economic growth. During the 1980s, 1990s, and until recently, deviations were smaller, policy was better, and economic performance improved; unemployment and inflation declined and growth picked up. In recent years policy has been poor and so has economic performance with high unemployment and low economic growth.

Many ask about how changes in the distribution of income fit into this story. While people with lower incomes benefitted from the less frequent recessions and lower unemployment during the Great Moderation of the 1980s and 1990s, the income distribution widened. As Emmanuel Saez of Berkeley and others have shown using IRS income data, the distribution became more concentrated in the upper tails starting in the mid to late 1970s and has remained concentrated, though the past decade with a deep recession and slow recovery has seen a hiatus in that trend.

There are of course a number of limitations of such income distribution statistics: IRS data are not ideal for measuring income because people simply report more income when the tax rate goes down. Taxes and transfers are not in the IRS income data, and these reduce inequality. Consumption is less unequal than income by many measures. Equality of outcome is not the same as equality of opportunity or personal equality (“all men are created equal”). Income mobility and intergenerational mobility are not captured by these data. A good absolute safety net is more important than the relative income distribution which is emphasized in such data. There are benefits from inequality of outcomes including the performances of Beyonce or Jay-Z and the many benefits from philanthropy.

But even considering these issues, the widened income distribution is a cause for concern in my view because it indicates harm to those at the bottom and signals a growing inequality of opportunity.

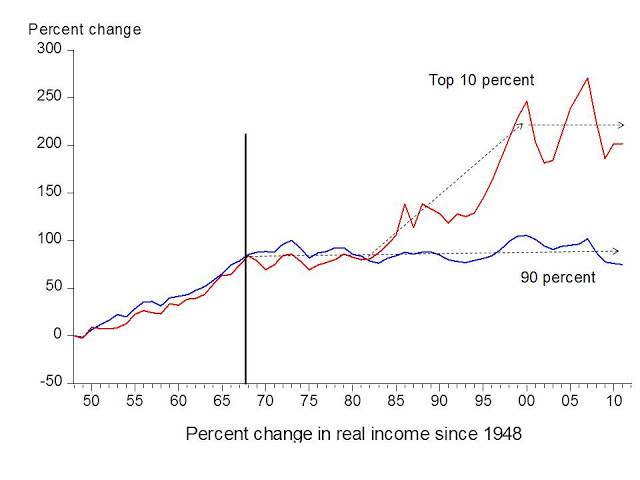

To better understand what is happening, I find the following chart quite revealing. It shows real income growth since the end of World War II for the upper 10% and the lower 90 % income groups. It is based on the Saez data. From the end of World War II until the mid-1960s real income growth was strong across the board, and thus there was relatively little change in the distribution of income. Then, in the late 1960s and 1970s the growth of real income slowed dramatically for both groups. This coincided with the terrible economic policy and the economic turbulence of that era. Then, coinciding with the Great Moderation of the 1980s and 1990s, income growth sped up. But most growth was in the upper income group, with the lower 90% seeming to move sideways. In more recent years, which coincide with the swing back to less effective economic policies, income growth has slowed again across the income distribution.

The slow income growth for all in the 1970s and in recent years is consistent with the story about deviations from economic freedom. But what was going on in the 1980s and 1990s? Why was an increase in economic freedom associated with a speed up of income growth for the upper income group and not others?

A large body of research documents that returns to education started increasing in the 1980s as evidenced by the growing college and high school wage premium. If the supply of those completing high school, with some going on to college, had increased to keep pace with the increase in returns, it is unlikely that we would have seen such a large widening of the distribution. But supply did not increase. High school graduation rates hit a peak around 1970 and then started declining. The US international rank in test scores fell.

The source of the income distribution problem is thus related to a poor education system. We are restricting educational opportunities, especially for those who are disadvantaged.

In other words the explanation for the widening inequality is the restriction of economic freedom rather than the promotion of economic freedom. Economic freedom did not mean economic freedom for all. Remember the students from the movie “Waiting for Superman”: Bianca, Emily, Anthony, Daisy, and Francisco who had such a small chance of winning the lottery to get into a school that would open up such opportunities? Adhering more closely to the principles of economic freedom requires giving those kids more freedom of choice.

Not extending economic freedom to all in the area of education is only one example of how deviations from economic freedom can adversely affect the distribution of income. Regulatory capture by large firms, crony capitalism, deviations from the rule of law, bailouts of the creditors of large financial firms, and highly discretionary monetary policies which largely benefit insiders are other examples.

Ironically some argue that moving further away from the principles of economic freedom—with higher marginal tax rates or more regulations on firms or more discretion for regulators or more interventionist macro policy—is the way to improve the economy and the distribution of income. That would be a great tragedy since history shows that over the long haul it has been more economic freedom that has pulled people out of poverty. The point is not that income distribution isn’t a problem; it is that a poor diagnosis of the problem will lead us in the wrong direction.