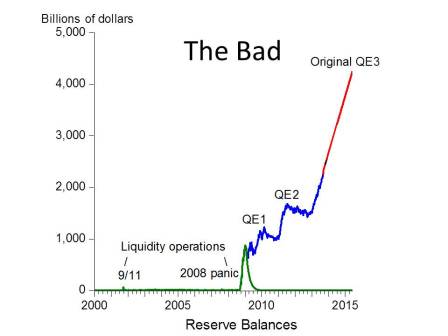

Last week I was invited by Macroeconomic Advisers to participate in their interesting annual Washington Policy Seminar, and to be on a panel with Larry Meyer. They called the panel: “Fed Policy: The Good, the Bad, and the Ugly.” So I prepared a few charts on the Good, the Bad and the Ugly. Since then I have prepared a fourth chart: the Uglier.

Chart 1 is the Good. It plots the amount of Fed-supplied liquidity (measured by reserve balances of the banks at the Fed). It shows the increase in liquidity at the time of the 9/11 terrorist attacks of 2001, when the payment system was physically damaged, and also the increase in liquidity at the time of the panic of 2008. These actions represent good monetary policy in the sense that the Fed acted in its lender-of-last resort capacity to provide liquidity in times of stress. You can see that the injection around 9/11 was properly short-lived. Although the lender of last resort facilities for the panic of 2008 were also short-lived (as shown in the graph), the total amount of reserves was not. The liquidity provisions did not end as in the Chart 1. Instead we got Chart 2.

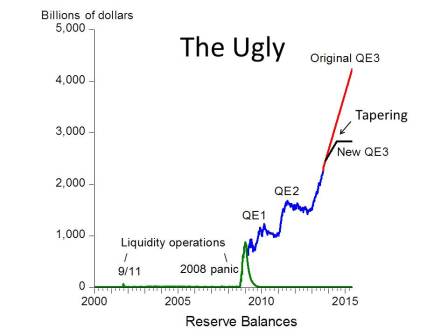

Chart 2 is the Bad. It shows the explosion of liquidity due to Quantitative Easing (QE) 1 and 2 (blue line) and the recent sharp increase due to QE3 announced in September and December of last year. The blue is what has already happened and the red is a continuation the original QE3 based on the hypothesis that the $85 billion per month would continue until labor market conditions improved (which originally could have been taken to be 6.5% unemployment rate).

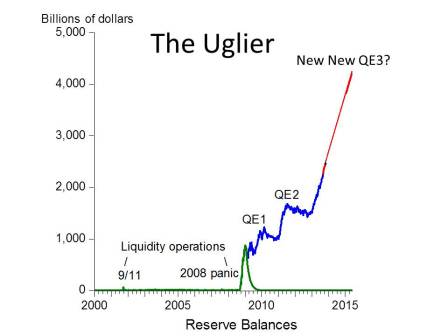

Chart 3 is the Ugly. It shows the first tapering announcement only 5 months after the start of the original QE3. Long term interest rates—which never really fell with QE3—were now on the rise.

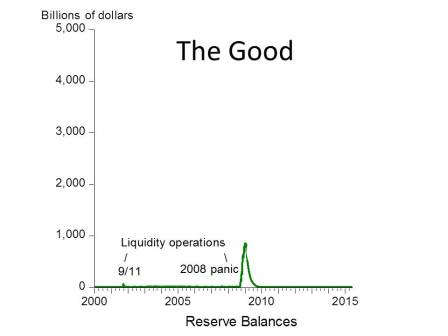

Chart 4 is the Uglier. It shows the surprise abandonment for now of the New QE3, and the start of a New New QE3. Who knows when and if that will end.