In his opening line of questions for Janet Yellen at the Senate Banking Committee today, Senator Richard Shelby asked about the use of monetary policy rules and the Taylor Rule, apparently referring to the recent policy rules bill (Section 2 of HR 5018) that would require the Fed to report its strategy or rule for policy. The headline-grabbing first sentence of Janet Yellen’s response was about not wanting to “chain” the FOMC to a rule, and it did get a lot of attention (including many real time tweets). But it was the rest of her response that really focused on the Senator’s question. Here is a transcript from C-Span (minute 28:39).

SENATOR SHELBY: YOU HAVE OPINED ON THE USE OF MONETARY POLICY RULES SUCH AS THE TAYLOR RULE, WHICH WOULD PROVIDE THE FED WITH A SYSTEMATIC WAY TO CONDUCT POLICY IN RESPONSE TO CHANGES IN ECONOMIC CONDITIONS. I BELIEVE IT WOULD ALSO GIVE YOU — GIVE THE PUBLIC A GREATER UNDERSTANDING OF, AND PERHAPS CONFIDENCE IN, THE FED’S STRATEGY. YOU’VE STATED, AND I’LL QUOTE, RULES OF THE GENERAL SORT PROPOSED BY TAYLOR CAPTURE WELL OUR STATUTORY MANDATE TO PROMOTE MAXIMUM EMPLOYMENT AND PRICE STABILITY. YOU HAVE EXPRESSED CONCERNS, HOWEVER, OVER THE EFFECTIVENESS OF SUCH RULES IN TIMES OF ECONOMIC STRESS. WOULD YOU SUPPORT THE USE OF A MONETARY POLICY RULE OF THE FED’S CHOOSING IF THE FED HAD DISCRETION TO MODIFY IT IN TIMES OF ECONOMIC DISRUPTION? >> CHAIR YELLEN: I’M NOT A PROPONENT OF CHAINING THE FEDERAL OPEN MARKET COMMITTEE IN ITS DECISION MAKING TO ANY RULE WHATSOEVER. BUT MONETARY POLICY NEEDS TO TAKE ACCOUNT OF A WIDE RANGE OF FACTORS SOME OF WHICH ARE UNUSUAL AND REQUIRE SPECIAL ATTENTION, AND THAT’S TRUE EVEN OUTSIDE TIMES OF FINANCIAL CRISIS. IN HIS ORIGINAL PAPER ON THIS TOPIC, JOHN TAYLOR HIMSELF POINTED TO CONDITIONS SUCH AS THE 1987 STOCK MARKET CRASH THAT WOULD HAVE REQUIRED A DIFFERENT RESPONSE. I WOULD SAY THAT IT IS USEFUL FOR US TO CONSULT THE RECOMMENDATIONS OF RULES OF THE TAYLOR TYPE, AND OTHERS, AND WE DO SO ROUTINELY, AND THEY ARE AN IMPORTANT INPUT INTO WHAT ULTIMATELY IS A DECISION THAT REQUIRES SOUND JUDGMENT.

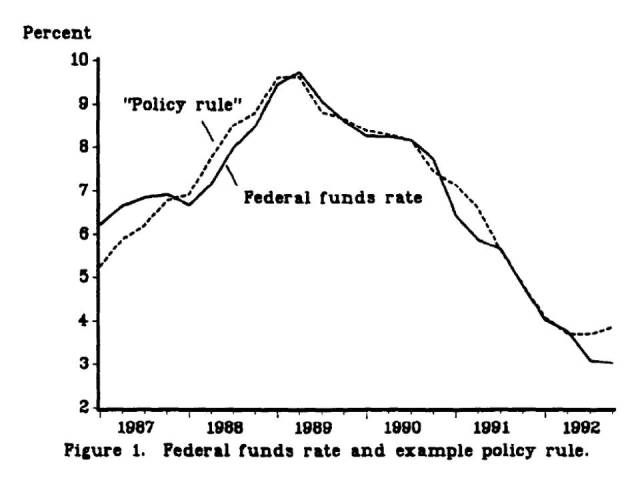

Note how Janet Yellen refers to my 1993 paper where I pointed to the 1987 stock market break as a case where there was a deviation from the Taylor rule. However, this example is really an illustration of how the policy rule legislation would work effectively rather than a critique of the legislation. To see this, take a look at this chart from my original paper:

Notice how the funds rate was cut in 1987 while the policy rule setting kept rising. This is the deviation that Janet Yellen was referring to. It is actually quite small and temporary, but in any case the Fed could easily take such an action and stay within the terms of the policy rules bill. The Fed chair would simply explain the explicit reason for the deviation as required in the legislation. I can’t imagine the case would be difficult to make given the size of the shock unless for some reason the deviation continued long after the shock. This example illustrates a feature not a bug in the bill